Specialist Shipping Compliance

As industry specialists in shipping New Zealand wine home to international customers since 2006, we pride ourselves on our vast depth of knowledge in all facets of Direct to International Consumer wine shipping.

While we manage, prepare, and submit wine export compliance for departure from New Zealand, we need your support to ensure you're compliant for both export & import customs.

Your Customer's Shipping Sale

Fulfilment, Receival, & Repacking

Invoicing

Export Compliance

Import Compliance

Destination Delivery

MPI Export Eligibility

A brief refresher on your Export Eligibility requirements for DTiC shipping sales. These are common Export Eligibility situations relevant to your WCD shipping shop & portal capabilities.

An in-person Cellar Door customer is placing their shipping sale while logged into the producer's e-Cellar Door shipping portal.

Your customer voluntarily (without responding to an offer/call to action) purchases via the producer's e-Cellar Door, using their own personal device.

The producer has sent an electronic invitation to purchase to their international customer base, wine club, or loyalty program.

No export eligibility requirements apply.

Your customer is purchasing and exporting to themselves, for their own personal use.

No export eligibility requirements apply.

Your customer is purchasing and exporting to themselves, for their own personal use.

Yes, the wine being offered for sale must be export eligible.

If the sale is 27L or below, an Export Eligibility Statement is not required.

*If the sale is +27L an Export Eligibility Statement is required.

Certificate of Label Approval (COLA) - US Only

For shipping sales to the US, your wine labels must be approved for COLA. We must hold your COLA under our import license. During the onboarding process, we will arrange this with you.

COLA are not vintage specific, but if your labels change, or you are releasing a new wine, send us a copy of the new labels for assessment.

Food Facility Registration (FFR) - US Only

For shipping sales to the US, your wine producing facility must be registered with the FDA.

If you do not already have Food Facility Registration, we will arrange this with you during the onboarding process, as your US shipping entity.

Customs Declarations

The accuracy of your shipping sales orders regarding 1) the end-receiver and 2) the order for export & import, should be sufficiently assessed for submission to both import & export customs, our destination partners, and the destination carriers.

While our team are vigilant when preparing your documentation for export & import customs, you need to ensure the details provided to us through your shipping portal are as accurate as possible. This includes the alcohol by volume, grape varieties, bottle format, and sale value, as well as the details of your customer.

Fulfilment for Export

After your shipping sale is submitted, you will pack the order for receival by our Auckland warehouse. You need to ensure the wine you are dispatching to us is accurate against the order/fulfilment request. See Fulfilment Procedures here. If there is any change to the shipping sale, notify us prior to your dispatching the wine support@wcdshipping.co.nz.

Our warehouse team do their best to confirm the wine you have dispatched is correct against your customer's shipping sale, however the responsibility is ultimately on you fulfilling your customer's order accurately.

Destination Delivery

The values and receiver details for each of your shipping sales are declared to the destination carrier. This is to verify the carrier can still provide a service into the receiver's area. Further, the net value you declare on the shipping sale is the upper limit insurance will cover.

Inaccurate receiver details unfortunately cause issues with delivery, which incur return and redelivery costs, while also increasing the risk of damage or loss due to avoidable additional transport and handling.

In some rare cases, there can be a sudden change to the destination service areas (due to changes in state permits or licensing). We will work with you and your customer to resolve this, should it occur.

Your WCD Shipping Shop

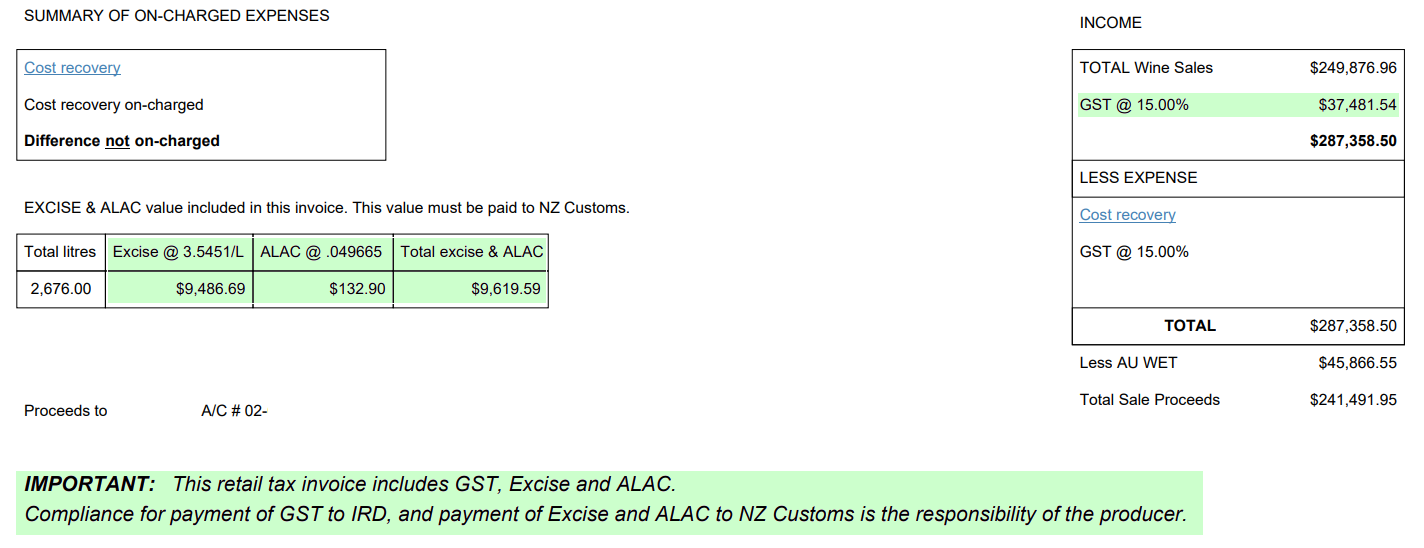

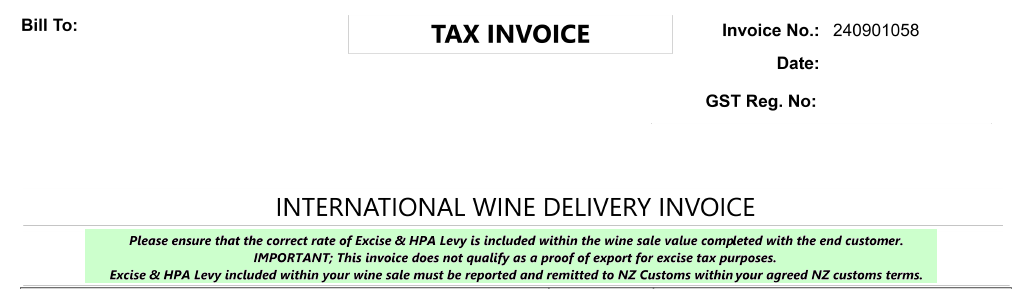

Your WCD Shipping Shop/e-Cellar Door orders are subject to the GST, Excise, and HPA Levy, the same as if the wine was sold to a domestic customer in New Zealand.

It's important to note these are not an extra charge. When you enter your Sale Proceeds to MANAGE WINE, you are indicating the net value. With this, the WCD system calculates the relevant taxes & duties for each destination, including adding 15% for the New Zealand GST and collecting this from your customer at the point of sale. Read more here.

The GST, Excise, and HPA Levy are remitted to you with your weekly Producer Payment. This is estimated on your Proforma invoice, and confirmed on your final IRD-Approved Buyer-Created GST Invoice. You subsequently remit these to the relevant authorities.

Club Uploader

Club uploader orders are subject to the Variable Delivery Fee. This is equivalent to the Excise, HPA Levy, and 15% that would have been GST, if the wine was sold to a domestic customer in New Zealand.

These are applied towards:

-customs clearance related expenses

-import taxes & duties

-import surcharges: bunker adjustments, security screening, anti-terrorism and war risk levies, etc.

-destination cartage expenses

It's important to note these are not an extra charge. They are already covered within your wine sale price, paid by your customer. The GST on Club Uploader orders can be zero-rated with the IRD.

Excise, HPA Levy, & GST collected from your customer and paid to relevant NZ authorities.

Excise, HPA Levy collected from your customer paid to relevant NZ authorities. 15% GST-Equivalent collected from your customer and transferred to WCD Shipping.

Australia

Australia Belgium

Belgium China

China Germany

Germany Hong Kong

Hong Kong Italy

Italy Japan

Japan Netherlands

Netherlands Singapore

Singapore South Korea

South Korea UK Mainland

UK Mainland UK Non Mainland

UK Non Mainland Northern Ireland

Northern Ireland Alaska

Alaska Hawaii

Hawaii EU€

EU€ UK£

UK£ NZ$

NZ$ CA$

CA$